Forex Trading Basics A Beginner’s Comprehensive Guide

Forex Trading Basics: A Beginner’s Comprehensive Guide

Forex trading can be a fascinating and profitable endeavor for those willing to learn. As a beginner, understanding the fundamentals is paramount to success. This guide will provide you with the essential knowledge needed to navigate the forex market effectively. If you’re looking for trustworthy professionals and platforms, consider exploring forex trading basics beginners guide Forex Brokers in Jordan for reliable options as you start your trading journey.

What is Forex Trading?

Forex trading, or foreign exchange trading, is the act of buying and selling currencies on the global market with the aim of making a profit. The forex market is a decentralized global market where currencies are traded, and it is the largest financial market in the world. Trading is usually conducted through a broker or financial institution, and transactions involve the exchange of one currency for another.

Understanding Currency Pairs

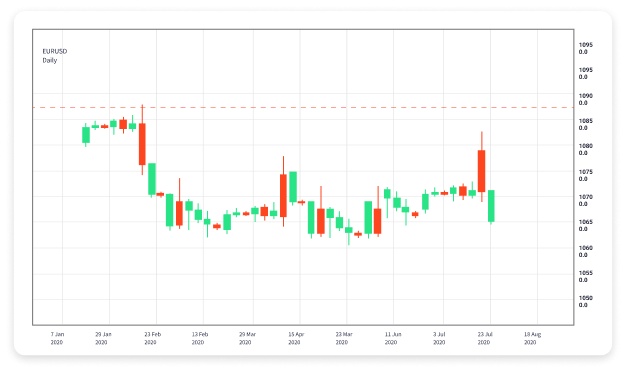

In forex trading, currencies are traded in pairs, meaning you buy one currency while selling another. Each currency pair consists of a base currency and a quote currency. For example, in the currency pair EUR/USD, the Euro (EUR) is the base currency, and the US dollar (USD) is the quote currency. The price of the pair reflects how much of the quote currency is needed to purchase one unit of the base currency.

Major, Minor, and Exotic Pairs

Currency pairs can be categorized into three main types:

- Major Pairs: These are the most commonly traded pairs that include the US dollar. Examples include EUR/USD, USD/JPY, and GBP/USD.

- Minor Pairs: These are currency pairs that do not include the US dollar but involve other major currencies, such as EUR/GBP or AUD/NZD.

- Exotic Pairs: These pairs involve a major currency paired with a currency from an emerging economy. Examples include USD/TRY (Turkish Lira) and EUR/MXN (Mexican Peso).

How Forex Trading Works

The forex market operates 24 hours a day, five days a week, which provides ample opportunities for traders to enter and exit positions. Trading typically occurs in three major sessions: the Asian session, the European session, and the North American session. Traders can capitalize on changing market conditions and economic news that affect currency values.

Leverage in Forex Trading

One distinctive feature of forex trading is the use of leverage, which allows traders to control larger positions than their capital would otherwise allow. For instance, with a leverage of 100:1, a trader can control a $10,000 position with just $100 in their account. While leverage can amplify profits, it also increases the potential for losses, making risk management crucial.

Types of Orders

When trading, you can place different types of orders:

- Market Order: An order to buy or sell a currency pair at the current market price.

- Limit Order: An order to buy or sell a currency pair at a specified price or better.

- Stop Order: An order to buy or sell a currency pair once it reaches a certain price, often used to limit losses.

Technical and Fundamental Analysis

Successful forex trading requires a solid understanding of both technical and fundamental analysis. Technical analysis involves studying price charts and using indicators to predict future price movements, while fundamental analysis focuses on economic news, events, and reports that may impact currency values.

Indicators and Tools

Many tools and indicators can assist you in making informed trading decisions. Popular technical indicators include:

- Moving Averages: Help smooth price data to identify trends.

- Relative Strength Index (RSI): Indicates whether a currency is overbought or oversold.

- Bollinger Bands: Used to indicate volatility and price levels.

Risk Management

Effective risk management is crucial for long-term success in forex trading. Consider implementing the following strategies:

- Use Stop-Loss Orders: Always set stop-loss orders to minimize potential losses on a trade.

- Only Risk a Small Percentage: Risk only a small percentage of your trading capital on a single trade.

- Diversify Your Trades: Avoid putting all your capital into one currency pair or strategy.

Choosing a Forex Broker

Choosing the right forex broker is essential for your trading success. Consider the following factors when selecting a broker:

- Regulation: Ensure the broker is regulated by a reputable authority.

- Trading Platform: Look for a user-friendly platform with necessary tools and features.

- Spreads and Commissions: Compare fees to minimize trading costs.

Tips for Beginner Forex Traders

As a beginner in forex trading, keep the following tips in mind:

- Start Demo Trading: Practice with a demo account before trading with real money.

- Develop a Trading Plan: Create a trading strategy with clear goals and guidelines.

- Stay Informed: Keep up with financial news and economic calendars to make informed decisions.

- Be Patient: Trading success takes time, so avoid rushing into trades.

Conclusion

Forex trading offers exciting opportunities for profit and learning. By understanding the basics, employing solid risk management techniques, and staying informed, beginners can develop the skills necessary for success in this dynamic market. As with any investment, remember to trade responsibly, and consider starting your journey with a demo account to build your confidence.