Essential Guide to Trading Platforms for Forex Features, Benefits, and Choosing the Right One

Essential Guide to Trading Platforms for Forex: Features, Benefits, and Choosing the Right One

In the vast world of financial trading, one sector stands out prominently—the foreign exchange market, commonly known as Forex. With trillions of dollars traded daily, Forex offers immense opportunities for traders. However, to maximize these opportunities, having the right trading platform is essential. A reliable trading platform can mean the difference between success and failure in the volatile world of Forex trading. In this comprehensive guide, we will review different types of trading platforms and how to select the best one for your trading style and needs. For further insights, be sure to check out trading platform for forex tradingarea-ng.com.

What is a Forex Trading Platform?

A Forex trading platform is software offered by brokers that traders use to access the financial markets. Through these platforms, traders can buy and sell currency pairs, manage their accounts, analyze market trends, and utilize trading tools and indicators. Essentially, it serves as the interface between the trader and the forex market.

Key Features of Forex Trading Platforms

When evaluating various Forex trading platforms, several key features come into play:

- User Interface: A user-friendly interface is crucial for seamless navigation. The simpler it is to navigate, the easier it is to execute trades efficiently.

- Order Types: Different platforms provide various order types—market orders, limit orders, and stop-loss orders. Having multiple order options enhances flexibility in trade execution.

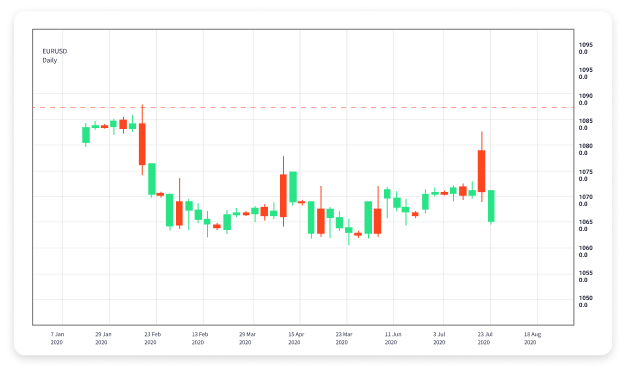

- Charts and Indicators: Advanced charting tools and technical indicators are essential for market analysis. Look for platforms that offer a variety of charting options and real-time data.

- Mobile Trading: With the rise of mobile technology, having a platform that supports mobile trading allows traders to manage their accounts on the go.

- API Access: Advanced traders may appreciate platforms that provide API access for custom trading strategies and automated trading solutions.

Types of Forex Trading Platforms

Various types of Forex trading platforms are available, each serving different trading styles and preferences. Here are the primary types:

1. Web-based Platforms

Web-based platforms are accessible through web browsers and do not require any installation. They are ideal for traders who prefer flexibility, allowing access from any device connected to the internet.

2. Desktop Platforms

Desktop platforms are applications installed directly on your computer. They typically offer a broader range of features compared to web-based platforms, making them suitable for professional traders who require advanced tools.

3. Mobile Platforms

Mobile trading platforms allow traders to execute trades on smartphones and tablets. These platforms are designed for traders on the move, providing essential functionalities for trading anytime, anywhere.

4. MetaTrader Platforms

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular platforms known for their advanced features, including automated trading capabilities and extensive customization for traders. They support various trading instruments, not just forex.

Benefits of Using Forex Trading Platforms

Using a dedicated Forex trading platform offers numerous advantages:

- Accessibility: With most platforms available on multiple devices, traders can access their accounts anytime, ensuring they never miss a trading opportunity.

- Advanced Trading Tools: Forex platforms often come equipped with analytics tools that help traders make informed decisions based on real-time market data.

- Security: Reputable platforms prioritize user security, utilizing encryption to protect personal and financial information.

- Efficiency: Speedy execution of trades reduces the chances of slippage and ensures the best pricing for trades.

- Demo Accounts: Most platforms offer demo accounts, allowing beginners to practice trading without risking real money.

How to Choose the Right Forex Trading Platform

Choosing the right Forex trading platform can be daunting due to the abundance of options. Here are some tips to help you make a sound decision:

- Determine Your Trading Style: Whether you are a day trader, swing trader, or long-term investor, your trading style should influence your choice. Evaluate what tools and features would benefit your particular style.

- Research Broker Reputation: Choosing a platform typically means selecting a broker. Research their reputation, client reviews, and regulatory compliance to ensure you are dealing with a trustworthy company.

- Assess Fees and Commissions: Look for hidden fees and understand the commission structure. Lower fees can significantly impact long-term profitability.

- Test the Platform: Many brokers offer demo accounts. Test the platform to understand its features, usability, and performance before committing real funds.

- Customer Support: Reliable customer support is critical. Make sure the platform offers multiple channels for support, including live chat, email, and phone assistance.

Wrap Up

In conclusion, selecting the right Forex trading platform is vital for traders looking to capitalize on global currency fluctuations. With numerous platforms available, evaluating the features, types, and benefits will guide you toward making an informed decision. Always remember to prioritize factors such as user-friendliness, security, fees, and customer support. Start exploring the options available and take the first step towards mastering Forex trading!