32 Totally free Spins $1 Put Gambling enterprises Better of 2024

You can search up the authorizing agency individually and make contact with them to determine why it delivered the brand new payment. The newest Internal revenue service has granted all the very first, next and you may 3rd Financial Impression Payments. You could potentially no longer make use of the Rating My Percentage software to help you look at your percentage position.

A close look ahead individual bank account advertisements

Basically, employees are defined either lower than common-law or less than laws to have particular pop over to the web-site issues. When you have a tax question not replied through this publication, consider Internal revenue service.gov and the ways to Score Income tax Let at the conclusion of so it book. Disaster taxation save can be found for those influenced by catastrophes. To learn more regarding the emergency recovery, go to Internal revenue service.gov/DisasterTaxRelief. It collaborative room lets users so you can lead more information, information, and you will expertise to compliment the original offer post. Feel free to show your knowledge that assist fellow customers create informed behavior.

- The company membership your discover will establish how much extra currency you could potentially qualify for.

- Zero step is needed to possess qualified taxpayers for these types of costs, that may date instantly in the December and ought to arrive in most cases from the late January 2025.

- Including dumps try insured independently regarding the personal dumps of your own business’s citizens, stockholders, lovers or people.

- The application form mostly consists of a few volunteer arrangements made to improve idea money reporting from the enabling taxpayers to learn and fulfill its tip revealing requirements.

- Wages paid off so you can a young child under 18 focusing on a ranch that’s a sole proprietorship or a partnership where for every companion try a daddy out of children aren’t susceptible to societal security and you will Medicare taxation.

Best checking account incentives to possess October 2025

It limitation applies to the newest combined hobbies of all beneficiaries the brand new proprietor has called inside revocable and you may irrevocable trust profile from the exact same bank. “Self-directed” implies that plan professionals feel the straight to direct the way the money is invested, including the capability to lead one deposits be placed during the a keen FDIC-covered bank. It point refers to the next FDIC ownership kinds plus the criteria an excellent depositor must meet in order to qualify for insurance a lot more than $250,one hundred thousand during the you to covered bank. The new FDIC makes sure dumps that any particular one keeps in a single insured bank on their own away from people deposits that individual is the owner of in another individually chartered covered bank. For example, if a person features a certification away from put during the Bank A good and it has a certification away from put in the Financial B, the fresh account create for each and every end up being insured on their own around $250,000. Money placed within the independent branches of the identical insured financial is actually maybe not individually covered.

High-produce discounts membership: Advantages and disadvantages

An employee protected by a keen HDHP and you may a healthcare FSA or a keen HRA you to definitely pays or reimburses qualified medical costs is’t basically build benefits in order to an HSA. An enthusiastic HDHP might provide preventive care benefits instead of a deductible or having a good deductible below minimal annual deductible. Precautionary proper care comes with, but isn’t simply for, next. For those who meet these requirements, you’re a qualified personal whether or not your spouse features low-HDHP members of the family exposure, given your spouse’s coverage doesn’t shelter you.

✔ Opening numerous account

If you are trying to find FDIC deposit insurance coverage, only make sure you are establishing their fund inside the a deposit unit during the financial. Because the 1933, the fresh FDIC seal have displayed the security and you can shelter in our nation’s loan providers. FDIC put insurance coverage permits people in order to with certainty put their money during the 1000s of FDIC insured banks all over the country, that is supported by a full believe and you can borrowing of one’s All of us government. Deposit insurance rates protects depositors contrary to the failure from an insured bank; it generally does not lessen losings because of theft or con, that are handled because of the almost every other regulations.

If you utilize a paid preparer to do Mode 945, the newest paid off preparer need to done and you can sign the newest repaid preparer’s section of the setting. For the most recent factual statements about advancements associated with Setting 945 and you can the tips, including regulations introduced when they had been composed, check out Irs.gov/Form945. Of several, or the, of your own issues appeared in this article are from the adverts couples who make up us when taking certain procedures to your the site otherwise simply click for taking an action on their website.

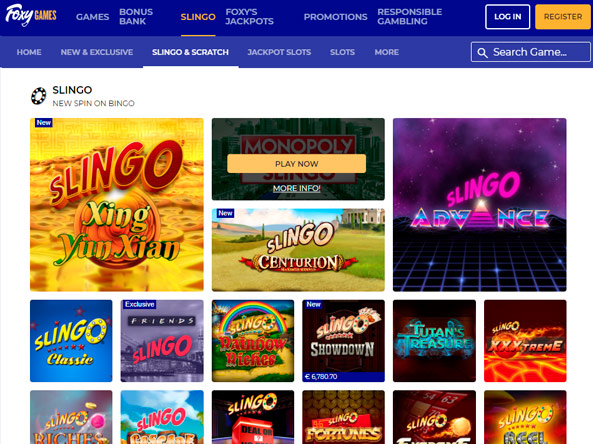

How to find reliable no deposit bonuses

You may also allege an enthusiastic overpayment (the sum of outlines 70a and 70b) as the a refund otherwise a card. See the applicable container online 71 to exhibit what type you’re stating. For individuals who claim a cards, it does decrease your needed deposits out of withheld taxation to have 2025. Note that for many who repaid the newest individual overwithheld number once season-prevent 2024 utilizing the reimbursement or set‐away from tips, you aren’t capable claim a refund to own for example an matter on the 2024 Setting 1042. Alternatively, you need to mean on the internet 71 that you are saying a great credit to be applied to the fresh 2025 season. If you’re unable to begin a deposit transaction to your EFTPS by the 8 p.m.

Your employees may not foot the withholding quantity to your a predetermined dollar matter otherwise percentage. Although not, an employee could possibly get specify a dollar add up to become withheld for each shell out period along with the quantity of withholding centered on submitting reputation and other information claimed for the Setting W-4. Repayments so you can group to have functions from the implement of condition and you will state businesses are at the mercy of government tax withholding however FUTA taxation. Extremely selected and appointed personal officials away from state otherwise local governments try personnel lower than popular-laws regulations.