Ideas on how to Trading Choices: 5 Steps to begin with

Choices are deals linked with a main advantage, used for short-term conjecture, money actions, otherwise hedging. The primary distinctions rest in the ownership framework, exposure publicity, day sensitivity, and you will prospective production. Options can also be joint to create a range of tips for various potential effects.

The two sort of possibilities

Learn how result-based ETFs allow it to be very easy to address certain economic wants. Investors looking for income possibly searching for a secure name means. Speaking of taken to account control and simple banking objectives.

The greater stock market is made up of several groups you may prefer to purchase. A great look will help buyers get the best organizations to spend within the. One thing to do are get acquainted with a company’s then occurrences https://nakhlaksa.com/feature-rich-exchange-robot-sol-trade/ , such large announcements or income releases, to see if offers is actually overvalued otherwise undervalued. Possible buyers will be confer with its individual income tax advisors concerning your income tax consequences based on their particular points.

- Futures consumers, simultaneously, are compelled to capture birth of your own underlying product on the deal except if it sell the newest package aside just before termination.

- Whether or not to choose a call otherwise a put choice, and you can whether to buy otherwise promote, relies on what you need to reach because the a tips buyer, claims Callahan.

- For the majority of account, it may take a few days for the money from your own financial to clear and stay obtainable in the newest brokerage account.

- Short choices traders typically discover hit cost which they think usually are still OTM from the termination.

Chance Government

To find a choice will provide you with the ability to buy or sell inventory in the a specific rate to your otherwise just before a certain go out if you exercise the possibility. Promoting an alternative obligates one purchase or offer inventory during the a specific price for the or ahead of a particular date if you are assigned the choice. Planning your trading means very carefully prior to moving to the choices trading facilitate your sit concerned about your aims to-arrive your expectations, and is also crucial on your own trading trip.

What exactly are choices?

Check out that it videos to understand the fundamentals as opposed to a whole new language. In the two cases, the newest consumer away from a choice constantly gets the straight to decide in case your solution will be made use of, also referred to as working out the choice, otherwise do nothing and you can let it sooner or later expire. We’ve laid out the basics of just how choices works, now let’s run-through a specific analogy to display the way they performs used. In-the-money options are more pricey than just away-of-the-money possibilities because they provides intrinsic well worth. Each other choices have the same built-in value possible once they move ITM.

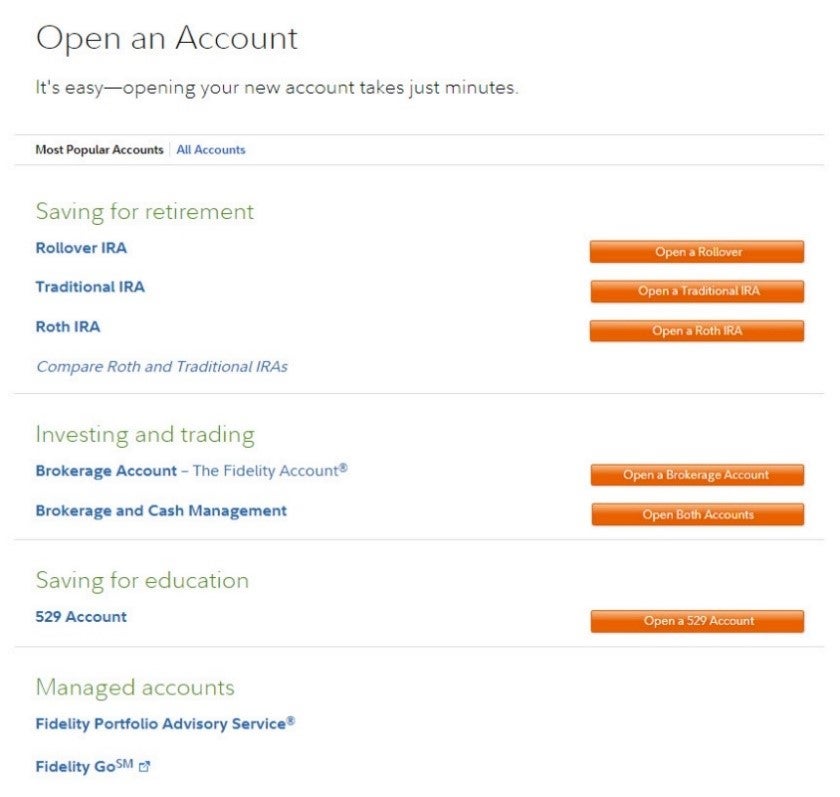

Beginning a brokerage account is different from opening an options trade account, especially if you want to trade to your margin (borrowing from the bank funds from their broker to help you change). Alternatives change agents may want to see your investment objectives, trade sense, private financial guidance and you may sort of choices to trade. Choices contracts is organized with particular conditions, such as the fundamental investment, the fresh hit speed, the brand new termination go out as well as the advanced.

Alternatives need not be challenging understand when you master their very first basics. Alternatives also have potential when made use of truthfully and will end up being hazardous whenever utilized improperly. If you’lso are not used to the choices globe, take your time to learn the newest the inner workings and practice just before getting down serious money. Western choices will likely be resolved each time prior to termination, but Eu possibilities might be worked out here at the newest mentioned expiration time. A long call are often used to speculate to your price of your fundamental rising because has endless upside prospective, but the limitation loss is the premium (price) paid for the possibility.

At the termination, the newest broker often automatically exercise the possibility should your cost of the root offers is higher than the worth of the brand new strike price. Set options offer the straight to promote the security in the the brand new struck speed when before termination. The brand new representative usually get it done the choice from the termination, however, on condition that the expense of the root offers try less than the value of the brand new strike rate before package expires. Solution deal owners aren’t required to take action their rights to buy or sell shares. They can allow the solution expire meaningless (and forfeit what they allocated to they), or they can promote the option offer to some other buyer to have any kind of matter one to buyer is actually ready to spend.

A choice try an agreement anywhere between two people that provides the brand new offer proprietor the proper, although not the obligation, to shop for or promote shares out of a stock during the a specified price to your or ahead of a specified date. If the stock’s speed decrease as well as the solution deal expired, you might nevertheless be out of the advanced cost of $step three for each display, in addition to people fee. Choices features book characteristics and you can risks and may be carefully sensed inside framework of your total investing package. Find out more from the which must look into trade options, or consult with an expert to make the better choice to possess your. In the Fidelity, you need to done an options application that explains the money you owe and you will paying feel, and read and you may indication an ideas contract. The choices Earnings Backtester unit makes you consider historic productivity to own money-focused choices positions, compared to possessing the new stock alone.

Lengthened expirations give the stock longer to move and you may date to suit your financing thesis playing aside. Therefore, the fresh prolonged the newest termination period, the more expensive the choice. Broker businesses display screen potential possibilities traders to assess its trading experience, its comprehension of the risks as well as their financial readiness. These records would be recorded within the an options trading arrangement used so you can demand acceptance from your prospective broker. Motion within the alternative cost will likely be told me because of the intrinsic value and extrinsic worth, which is also known as day worth. An option’s premium is the mix of the built-in well worth and you will date value.

What you need to Discover an options Change Membership

You will need to has a very clear mentality—what you think the marketplace is capable of doing and when—and you will a company idea of everything you desire to to accomplish. Which have a trading bundle set up enables you to a self-disciplined possibilities investor. Play with our maps to look at rates records and perform tech research to help you decide which struck prices to decide. Like all money choices you will be making, you will have a definite notion of what you hope to doing ahead of exchange options. If you predict a stock’s rates to know, you could pick a visit option or promote a made use of choice. For those who anticipate a stock’s rate to go laterally you could promote a trip choice or sell an utilized choice.