Sports Betting Growing as States Let Gamblers Wager Online

Sports Betting Growing as States Let Gamblers Wager Online

3 7 月, 2025 在〈Sports Betting Growing as States Let Gamblers Wager Online〉中留言功能已關閉In the 27 states where it’s legal, putting bets from a phone or other gadget has actually opened the door to much bigger audiences.

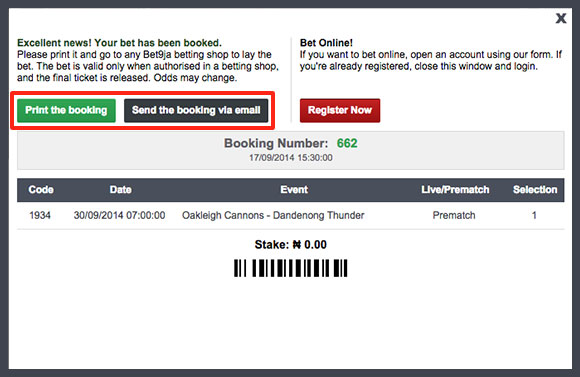

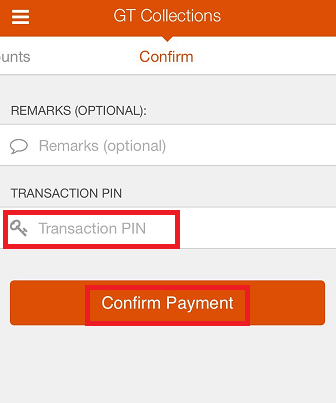

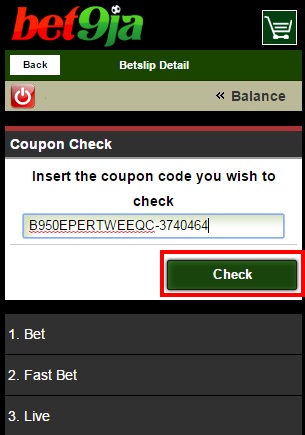

Placing a bet on a game or match is as simple as opening an app on your phone.

From workplace swimming pools to gambling establishments to online wagering apps, March Madness entices sports lovers and casual audiences alike to anticipate a winner of the annual NCAA college basketball competition.

Sports betting in gambling establishments or racetracks is now legal in 38 states and Washington, D.C. And that number keeps growing. As of this month, six more states-Alabama, Georgia, Hawaii, Minnesota (tribe handled), Missouri and Oklahoma-had measures pending to authorize sports betting.

Related: March Madness Induces the Bets

Some states have made betting even easier: 27 states with legal sports wagering have actually also authorized online sports betting (with legislation presently pending in Mississippi). Online sports wagering unlocks to much larger audiences because users can wager from a computer or mobile phone anywhere in the state.

While sports betting expanded rapidly after the U.S. Supreme Court got rid of the federal restriction in 2018, it’s not quite the wild west, as states have established some guidelines.

For example, some states restrict which sporting occasions go through bets. All states restrict betting on high school sports, but college sports betting is controlled differently in every state. Some states forbid betting on all college sports and athletic events, while others just prohibit betting on in-state groups. Other states have no limitations on college sports betting.

Here are information on how states control:

– Blanket prohibition on all college sports and athletic events: Oregon and Tennessee.

– Prohibition on in-state teams and in-state college occasions: D.C., New Hampshire, New Jersey, New York, Rhode Island ** and Vermont.

– Prohibition on in-state teams: Connecticut, Delaware, Illinois, Iowa, Maine, Massachusetts *, South Dakota **, Washington and Wisconsin.

– No constraints: Arizona, Arkansas, Colorado **, Indiana, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi **, Montana, Nebraska, Nevada, New Mexico, North Carolina, Ohio, Pennsylvania, West Virginia and Wyoming.

* Massachusetts allows banking on in-state groups when those teams are participating in a competition.

** Rhode Island, South Dakota, Colorado and Mississippi also forbid proposition bets on college sports and athletic events. So-called prop bets are side wagers that have absolutely nothing to do with the outcome of an occasion, such as betting on the first string to score, or perhaps the length of the pregame national anthem.

Lottery-Run Sports Betting

Lottery commissions in a number of jurisdictions-Washington, D.C., Montana, New Hampshire, North Dakota, Oregon, Tennessee, Virginia and Wyoming-partner with personal operators to provide sports wagering. In the district, the lotto commission uses its own sports wagering product in addition to partnering with personal operators.

Does Sports Betting Pay Off?

States create income from sports wagering by taxing jackpots. Tax rates on sports betting variety from 6.75% in Iowa to 51% in New York and Rhode Island. A couple of states levy various rates on retail and online wagering. Retail video gaming operators that online video gaming would siphon off casino and racetrack consumers and injure their bottom lines. In action, policymakers in some states developed a two-tier tax structure to give retail sports wagering a lower tax rate. While most states have a flat rate for sports wagering earnings, Arkansas and Mississippi use finished tax rates, and Vermont enforces various rates on the 3 various sports wagering operators. (For present state tax rates, see March Madness Brings On the Bets.)

Since the legalization of sports wagering, states have actually collected hundreds of countless dollars in tax income. The majority of that has actually originated from online sports wagering due to the fact that people who don’t frequent casinos can get in on the action through a mobile app or site. And more betting means more earnings.

Take Arkansas and New York City, for example. Both states broadened sports betting to consist of online wagering in 2022. The next year, tax collections doubled in Arkansas, with incomes going from less than $2 million in financial year 2022 to over $4 million in fiscal 2023. Similarly, New york city gathered less than $2 million in tax earnings during the very first nine months of financial 2021; after online sports wagering started in the last 3 months of fiscal 2021, earnings collections jumped to $163 million. The big increase in collections is due in part to the 51% tax rate on online sports wagering.

The experience in other states is comparable. In financial 2023, online sports betting comprised 92% of gross wagering invoices in Indiana and 89% of gross receipts in Pennsylvania.

However, tax earnings generated from sports betting is simply a portion of the gaming pie compared to overall gambling establishment earnings. According to the American Gaming Association, industrial gaming operators contributed over $14.4 billion in gaming taxes in 2023, compared to $2.1 billion from the sports betting industry.

Where Does the cash Go?

Sports betting offers a constant source of earnings for states, however it’s not without expenses.

Gambling dependency is an issue worsened by simpler access to sports wagering. In response, legislators in 14 states and D.C. allocate a part of sports betting revenue for problem gaming treatment. Other common recipients of wagering profits include education programs, regional federal governments and workforce development programs. Many states transfer the earnings into their general funds and designate the funds where they choose.